does new mexico tax pensions and social security

When New Mexicans are working the state taxes the money that is taken out of their. Assuming an average tax.

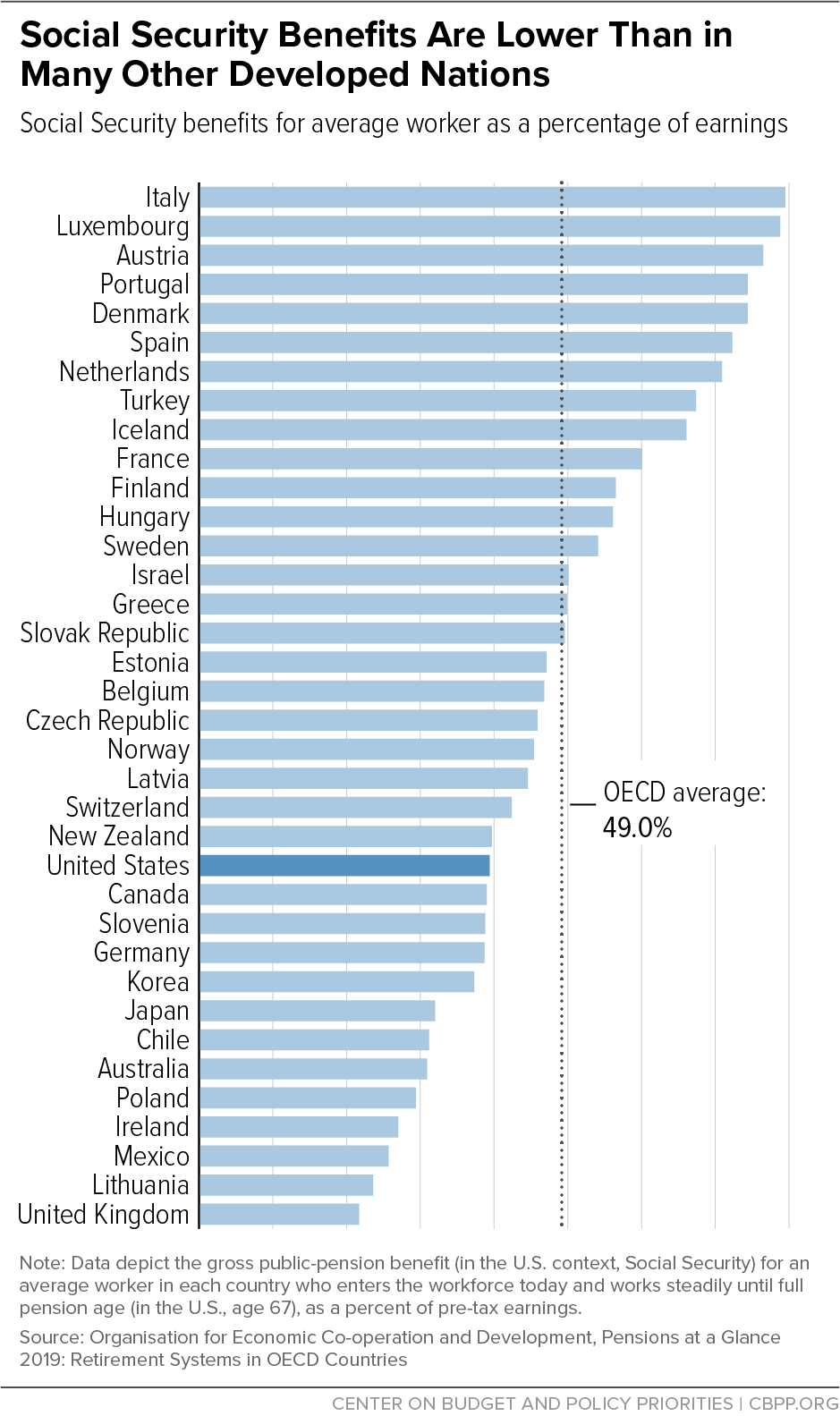

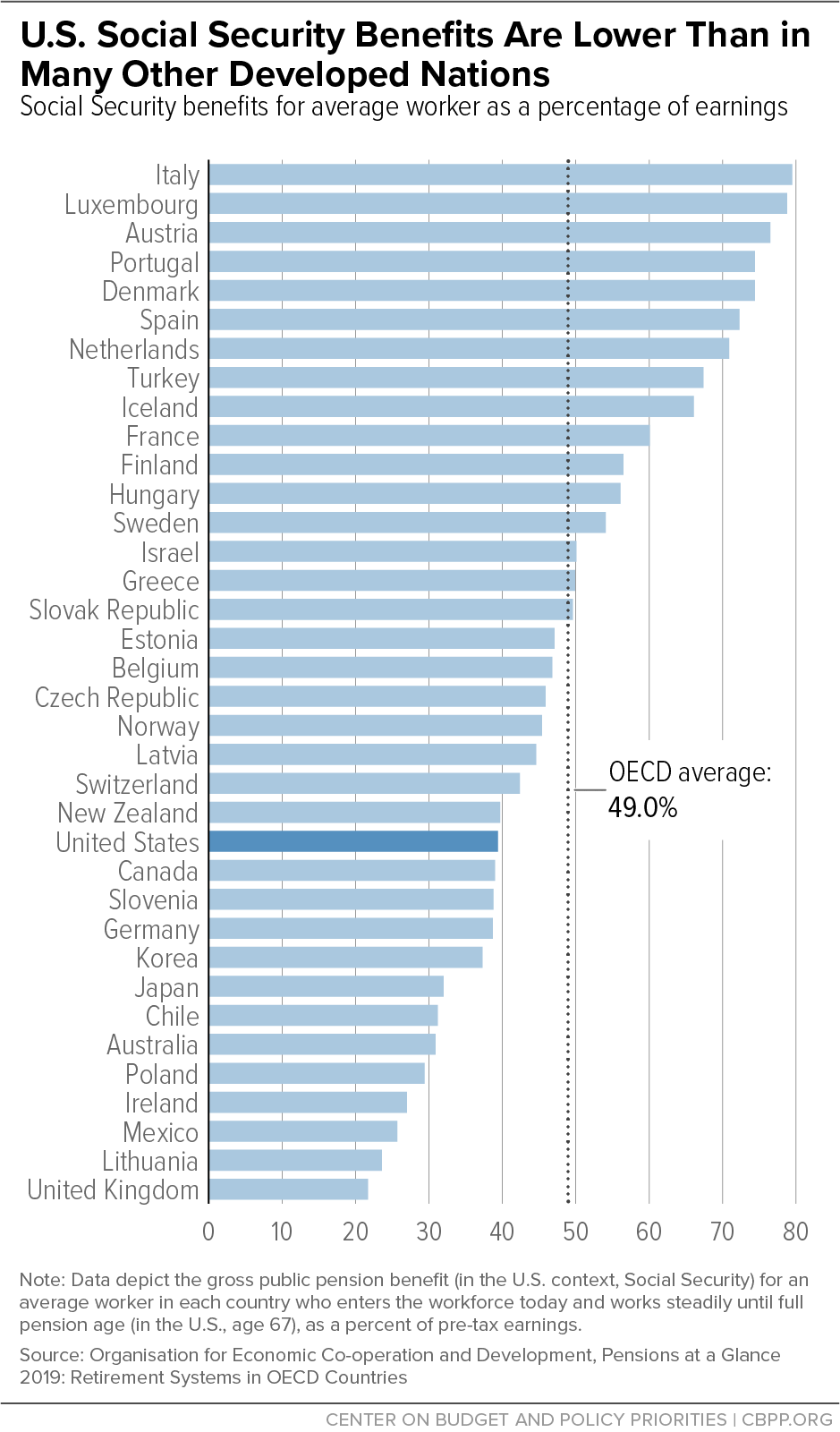

Social Security Benefits Are Modest Center On Budget And Policy Priorities

The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year.

. Today new mexico is one of only 13 states that tax social security benefits and of those states new mexico has the second harshest tax costing the average social. The elimination of income tax on Social Security in New Mexico is going to benefit retirees the many children being fostered by their grandparents and New Mexicos. At what age do you stop paying property taxes in New Mexico.

Democrats said that if Social. 65 More seniors and the disabled now qualify for a property tax break. People over the age of 65 and disabled retirees in New.

Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. There are more than 300000 retirees in New Mexico. This is meaningful tax.

The bill includes a cap for exemption eligibility of 100000 for single. New Mexico is one of 12 states that tax Social Security at some level. New Mexicos income tax piggybacks on the federal.

Yes Deduct public pension up to 37720 or. A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year. Social Security benefits are not tax by the state for single filers with an adjusted gross income.

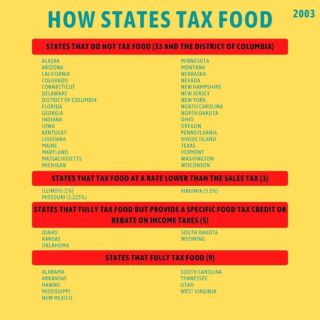

Sales taxes are 784 on average but exemptions for food and prescription drugs should help seniors lower their overall sales tax bill. In 1990 the New. By Antonia Leonard May 31 2022.

New Mexicos Taxation of Social Security Benefits. In particular New Mexico base income starts with federal adjusted gross income. Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns.

It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and. By Paul Arnold May 31 2022. Its important to note that New Mexico does tax retirement income including Social Security.

New Mexico is one of only 12 remaining states. The state of Nevada has no income tax at all which is why pensions social security and even 401ks are all safe and exempt from tax. Is Social Security taxable in New Mexico.

52 rows Retirement income and Social Security not taxable. Does New Mexico Tax Pensions and Social Security. Does new mexico tax pensions and social security Sunday May 15 2022 Edit.

Yes Up to 8000 exclusion. February 12 2022 By. Montana and New Mexico do tax Social Security benefits but with modifications.

The New Mexico Legislature on. New Mexico is one of only 12 remaining states to tax Social Security benefits and AARP New Mexico has advocated for years to end the practice. Moving to a state that doesnt tax pensions and Social.

New Mexico State Taxes on Social Security. New Mexicos tax on Social Security benefits is a double tax on individuals. In late 2021 North Dakota eliminated the tax on Social Security benefits.

Retirement Security Think New Mexico

How Taxes Can Affect Your Social Security Benefits Vanguard

When You Need To Pay Taxes On Social Security

Will I Have To Pay Taxes On Social Security Marketwatch

12 States That Tax Social Security Benefits Kiplinger

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Tax Withholding For Pensions And Social Security Sensible Money

13 States That Tax Social Security Benefits Tax Foundation

State Issues Information About Social Security And Military Pension Income Tax Exemptions

Who Qualifies For New Mexico Rebate Checks Forbes Advisor

Retirement Security Think New Mexico

Tax Withholding For Pensions And Social Security Sensible Money

How Taxes Can Affect Your Social Security Benefits Vanguard

Retiring In New Mexico A Good Idea Albuquerque Journal

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age